Turkey’s new trade agreements and India’s and China’s credit policies

Turkish President Recep Tayyip Erdoğan will tour the Gulf countries to attract investments and other financial resources totalling $25 billion. The trip is to cover the United Arab Emirates, Saudi Arabia and Qatar. Already, these countries provide the Central Bank of the Republic of Turkey through SWAPs and direct deposits with the currency the Turks need. The initiative of the Turkish president results from the decreasing investments of Western countries in Turkey.

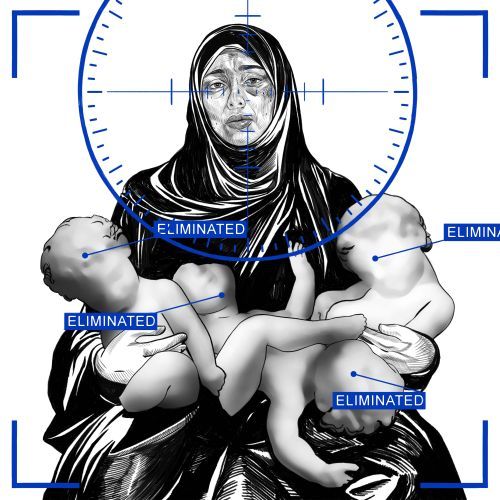

Jordan’s shale-oil-fired Attarat power plant was to be the country’s primary energy source and to strengthen relations with China. However, transactions related to the power plant drive Jordan into multi-billion dollar debts to China, and the power plant itself is no longer needed to generate energy. The Jordanian government is challenging the deal in an international legal battle. If it fails, Jordan will have to pay $8.4 billion to China over 30 years by buying the electricity generated by the power plant.

India is trying to rival China in expanding its influence on the resource-rich African continent. In the last decade, 42 African countries received about $12 billion from India. Only Asian countries received more ($17.1 billion). Credit lines opened in Indian banks are for healthcare, infrastructure, agriculture and irrigation projects. Mauritius, Tanzania, Sudan, Zimbabwe and Mozambique were the most willing to use them. For comparison, in 2010-2020, China committed itself to transferring $134.6 billion to African countries.