Speculating with water and the Taliban revenues

| Water is now available as a trade commodity on Wall Street, just like gold or oil. The new contracts will allow traders to “bet” on whether water prices will rise or fall. Representatives of the entities responsible for introducing the new financial instrument claim that it will help farmers manage price risk and prepare for the water scarcity, but the UN warns that it is opening a road to a speculative bubble.

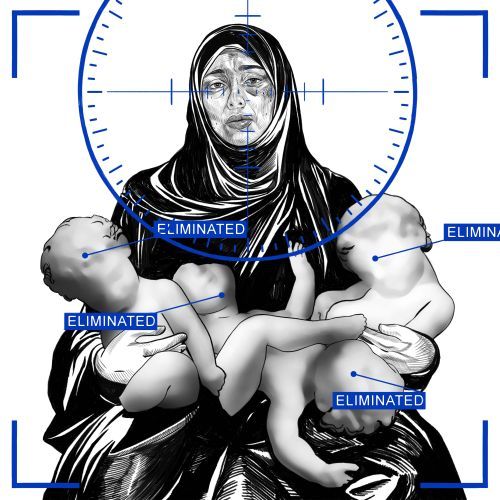

The water contracts will be settled financially – that means that they will not require any water to be physically delivered. According to Pedro Arrojo-Agudo, the UN’s special rapporteur on the human rights to safe drinking water and sanitation: “The news that water is to be traded on the Wall Street futures market shows that the value of water, as a basic human right, is now under threat”. Sub-Saharan Africa is the riskiest region for investments, according to the annual Terrorism Intensity Index by Verisk Maplecroft, a global risk and strategic consulting company. Seven out of 10 countries south of Sahara were called riskiest in terms of militant violence. Among the threats are also: dangerous transport routes and risks to companies and their staff. In the fiscal year ended in March 2020, the Taliban revenues totaled about 1,6 billion USD, compared to roughly 5,5 billion USD revenues of the Afghan government. According to Hanif Sufizada, who studies Taliban finances at the University of Nebraska, the group earns mostly on drugs, mining, extortion, and taxes imposed on the population of the controlled territories, exports, and even real estates. |