Green companies during crisis and troubles of Russian wine farmers

It pays off to be “green”. The companies more engaged in the ESG (Environmental, Social, and Corporate Governance) initiatives are more resilient during crises, according to research. Although some studies suggest that they may perform worse in a short time due to the heavier upfront investment costs in becoming environmentally and socially sustainable, they profit in the long term. The 2008 financial crash dented investor’s trust in purely financial criteria, which benefited companies with better reputations and more transparent extra-financial communication. In March 2020, when the global MSCI World Index fell 14,5%, almost two-thirds of large-cap investment funds focused on ESG outperformed it.

Chinese pigs are eating so much corn that it may affect the country’s green fuel plans. From 2020 China is adopting biofuel based on ethanol produced from corn as a measure of reducing pollution. So-called E10 fuel is a mixture of 10% corn-derived ethanol and gasoline. Now, corn has become less accessible in the market and therefore more expensive as Beijing started an initiative to raise the supply of pork. Together with that comes the use of ethanol as sanitizer during the pandemic. The E10 producer, Sinopec Group, is forced to reconsider the scale of sales.

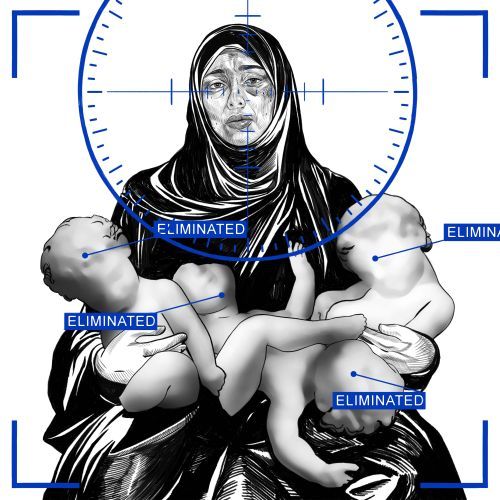

Small wineries on the Russian coast of the Black Sea may not survive as they struggle with bureaucratic requirements imposed by Moscow. The authorities claim they are fighting with unsanitary production, tax avoidance, and counterfeits. Although those issues are real, the cost of licensing (at least 6000 USD a year), and abiding by other regulations are projected to drive most winemakers out of business.