African economy: mukando clubs, the Kenyan crisis, and reforms in Nigeria

In Zimbabwe, popular community savings programs provide support for residents but also expose vulnerable people to the risk of fraud. These informal savings clubs, known as mukando, have become especially popular among women and people who are underemployed, distrust banks, or lack access to traditional savings and loans. The clubs typically consist of about a dozen members with a treasurer to whom money is donated, sometimes in partnerships with families, neighbours, or friends. These unregistered and unregulated organisations rely on trust between members, which experts warn can expose savers to fraud.

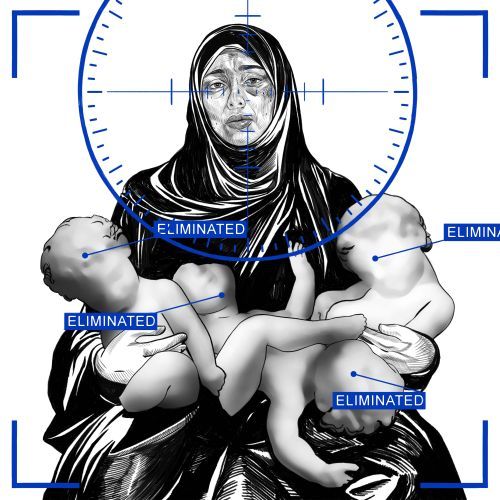

In Kenya, despite President William Ruto abandoning plans to raise taxes that sparked nationwide unrest last week, police are still clashing with protesters. Dozens of protesters have been killed in the clashes. The protest movement, which has no official leader and often organises itself on social media, has rejected the president’s calls for dialogue.

In Nigeria, President Bola Tinubu has implemented significant reforms, including lifting taxes on imported pharmaceuticals to boost local production. This move is part of a larger strategy to rebuild the economy and increase non-oil revenues. The Tinubu administration’s reforms have helped Nigeria secure international funds, including more than $2.25 billion from the World Bank, indicating the country’s economic progress.